How Your Money Story Shapes Your Financial Decisions Today

How Family Lessons and Early Experiences Influence the Way You Handle Money

We all have a money story. It’s the invisible narrative that we carry — built from our earliest experiences, family influences, and the lessons we absorbed (spoken or unspoken) about what money means. Our money story shapes how we spend, save, give, and even how we feel when we look at our bank account.

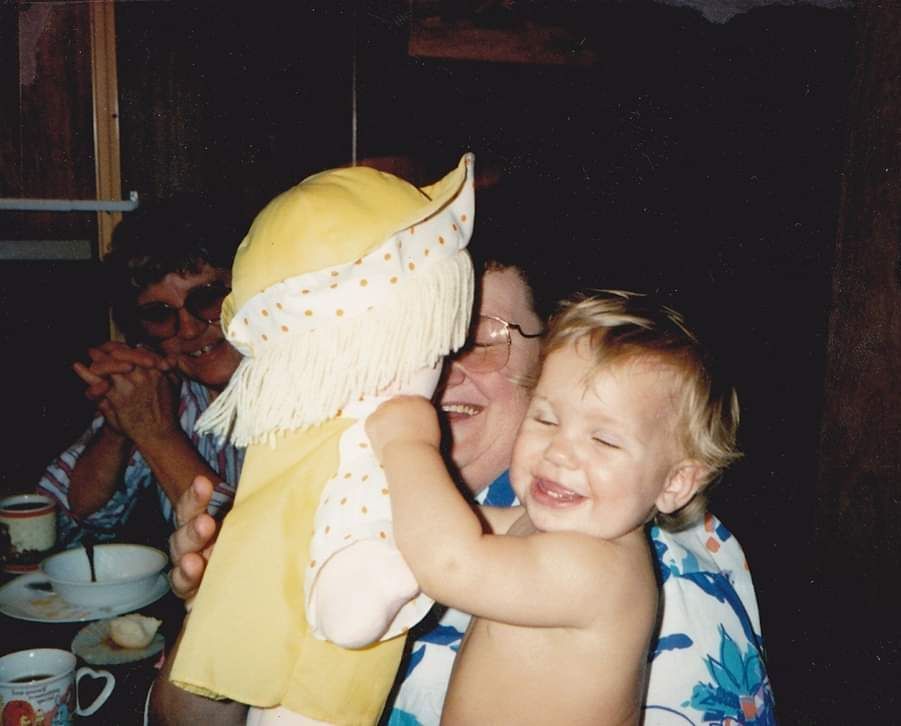

For me, my money story started on the dusty roads of central Montana...

I come from a long line of entrepreneurs — my grandparents, parents, and even many of my cousins and my brother have all built lives rooted in hard work and self-starting grit. Growing up, I didn’t just see that work ethic; I lived it. I spent my childhood riding along with my dad in his truck as he moved mobile homes across the plains. My first “jobs” were small — moving little wedges of wood to help block and level the homes — but as I got older, I found myself moving the heavier blocks and even driving pilot cars.

Those experiences taught me that goals are achieved through consistent effort. There were no shortcuts or guarantees, just hands-on work, problem-solving, and a lot of determination.

So when I imagined my adult life, I thought I’d follow a different, more “traditional” path: go to college, work my 30 years, retire, and enjoy the security I’d built. That was the version of stability I thought I needed… one that made sense in contrast to the uncertainty that comes with entrepreneurship.

But as I worked my way through my master’s degree in Counselor Education, something began to shift. I found myself drawn toward clinical and school counseling, spaces where I could really see people, listen deeply, and help them navigate the emotional layers of their lives. It was there that I began to understand how much our internal world shapes our external realities — especially around money.

I started noticing a pattern: when clients talked about their stress, their relationships, or their goals, money was almost always part of the story — but it was often the part left unsaid. So many people carry anxiety, shame, or confusion about their finances, yet struggle to talk about it openly. And I realized, that silence wasn’t random. It came from the stories they’d inherited, just like I had inherited mine. It didn’t feel safe to talk about money. It felt scary and unpredictably wrought with uncertainty.

For me, my story is one of earning — of equating hard work with worth, productivity with safety. It’s given me resilience and motivation, but it’s also shown me the importance of rest, reflection, and redefining success. For years I had to unlearn what the true definition of worth was and become a more sturdy version of myself to not constantly feel "not-enoughness." For others, their stories might be about scarcity, fear of losing what they’ve earned, or guilt about having more than those around them.

The thing about money stories is that they’re powerful, but they’re not permanent.

When we start to recognize where our beliefs come from, we begin to see that we have choices. We can honor the values our families gave us — like work ethic and independence — while also writing new chapters that include balance, compassion, and emotional freedom.

That’s the work I love most: helping people understand not just the numbers in their financial life, but the narratives that drive them. Because when we bring awareness to our money story, we can move from reacting out of fear or habit to making decisions rooted in clarity, intention, and self-trust.

Your money story got you here. But you get to decide where it goes next.

Begin Writing Your Money Story

One of the most powerful steps you can take toward financial clarity is to explore your own money story. Here’s a simple outline to help you begin:

Family Lessons Around Money

- What did you observe about money as a child?

- How did your parents, grandparents, or siblings handle money?

- What messages did you hear (spoken or unspoken) about spending, saving, or wealth?

Early Experiences

- Think of specific memories involving money.

- Were there moments of abundance, scarcity, or struggle?

- How did these moments make you feel at the time?

Personal Beliefs About Money

- What do you believe about money now?

- Do you associate money with security, stress, freedom, or something else?

- Are these beliefs serving you or holding you back?

Money Behaviors

- How do your beliefs show up in your spending, saving, or financial decision-making?

- Are there patterns that repeat, even when they don’t serve your goals?

Your Aspirations

- What kind of relationship with money would you like to have?

- How might your story evolve if you allowed yourself new possibilities?

Tip: Write freely without judgment. This is your story — there’s no “right” or “wrong,” only insight. Over time, reflecting on your story can help you make decisions that feel aligned with your goals, values, and the life you truly want to create.