Why Is Money Emotional?

How Sally’s Story Might Help You Understand Your Own.

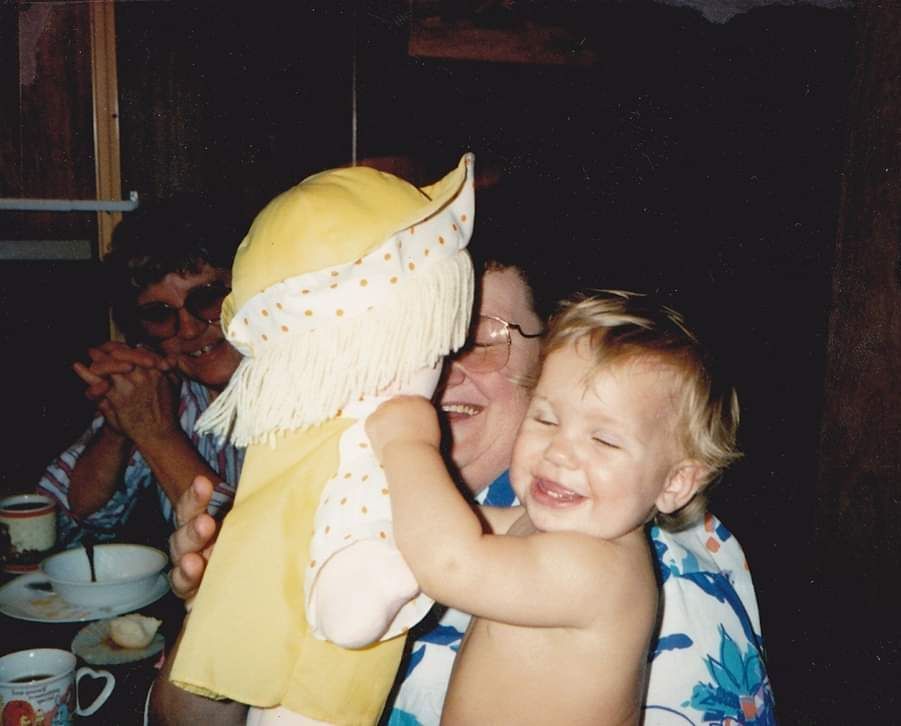

Sally is a 35-year-old mom of two. She works full-time, packs lunches, signs permission slips, and tries her best every single day to raise good humans. She also tries really hard to make sure her children have everything they need—and if she’s being honest, sometimes more than they need.

She’s not flashy. She’s not careless. In fact, most people in her life would say she’s incredibly thoughtful and generous. But every once in a while, Sally opens her credit card bill and feels a wave of shame roll in.

There it is. Target. Amazon. Target again. Another Amazon order. A few last-minute school purchases. A cart full of clothes because there was a sale. Birthday party favors. A backpack that matched their friends’. New shoes because the old ones were “ugly.”

And all of it? For the kids.

She scrolls through the charges and starts doing that thing—telling herself she should have known better, she should have waited, she should have said no.

But in the moment? Saying no didn’t feel like an option. She didn’t want her children to feel left out. She didn’t want them to feel how she used to feel.

You see, when Sally was growing up, money was tight. Her parents moved the family around constantly—new towns, new schools, new apartments. It always felt like they were starting over. And every time she showed up in a new place, kids would look her up and down, sizing her up by what she wore. Sally learned early on that showing up in the “right” clothes gave her a fighting chance. On the days she wore something new or fashionable, she felt like she belonged. But the days she had to wear something from Goodwill? She felt a quiet, aching shame—one she didn’t have words for then but still feels in her body now.

Even today, she can’t bring herself to walk into a secondhand store. Just the idea of it makes her stomach churn. And when her kids ask for something—whether it’s a cool sweatshirt or a new set of colored pencils—she finds herself saying yes almost automatically.

Because for Sally, spending on her kids isn’t just spending. It’s protecting. It’s proving. It’s rewriting a story she didn’t like living through herself.

And yet... those purchases still pile up. And sometimes, the tension in her relationship does too.

Sally’s partner doesn’t always understand why the Amazon boxes keep showing up. They’ve had more than a few arguments about money. It’s not that they’re on the brink of financial crisis, but the disconnect is real. He sees “extra stuff” piling up. She sees armor. He wants her to say “no” more often. She doesn’t know how to say no without feeling like she’s letting her kids down—or letting her past catch back up with her.

So she hides the bags. Deletes the order confirmation emails. Tries to justify the purchases out loud, but the defensiveness creeps in. The guilt. The confusion. The emotional overload.

And then that shame again.

This is why money is emotional.

It’s rarely just about budgeting or willpower. It’s about experiences we had before we even had a bank account. It’s about what we were told money meant—and what we felt it meant when we had it, or didn’t. It’s about identity, security, and love.

Sally doesn’t overspend because she’s irresponsible. She overspends because she remembers. She remembers what it felt like to be judged, to be left out, to feel like everyone could see right through her family’s struggles. And she’s doing everything in her power to make sure her kids don’t feel that way—even if it costs her peace of mind.

Do you see any part of yourself in Sally’s story?

Do you ever find yourself looking at your spending and wondering,

"Why did I do that?"

Do you ever feel guilty for saying yes too often, or ashamed when you try to say no?

Do money conversations with your partner bring up more emotion than you expect?

If so, you are not alone.

You are not “bad with money.” You’re human. And you’re carrying a whole lifetime of stories, beliefs, and emotional patterns around money—just like Sally.

That’s exactly why I created Flourish: A Women’s Financial Wellness Group.

Flourish is a 6-week guided group experience that goes beyond budgets and spreadsheets. It’s a place to explore your money story with honesty and compassion, surrounded by other women who are ready to do the same. We unpack the emotional patterns like Sally’s. We explore where they came from. And most importantly—we work on rewriting those patterns in ways that honor your past and support your future.

You don’t need to do this alone.

🪴 The next round of Flourish is starting soon. Six weeks. One hour a week. Real tools, real stories, and real change. Let’s grow together. 💚

If you’re curious if Flourish is a good fit for you, reach out. I’d love to help you find out.