What 56Strong Gave Me — and Why Being Named Mentee of the Year Means So Much

When I applied to be part of the 56Strong Women’s Mentorship Program, I knew I was signing up for something that had the potential to support me — but I didn’t know just how transformative it would be for me personally and for my financial therapy practice.

56Strong is a statewide initiative that matches women from each of Montana’s 56 counties into meaningful one-on-one mentoring relationships. The goal? To cultivate leadership, connection, and confidence among women across our state. In a place as vast and rural as Montana, creating strong ties across geography, experience, and industries is no small feat — and yet 56Strong does it with heart, intention, and an unshakable belief in the power of women supporting women.

As a mentee, I was paired with a mentor (BIG shout out to Amy Falcione @ Big Picture Marketing!!) whose insight, generosity, and wisdom became a grounding presence during a year full of growth and Big Life Stuff. Running two therapy practices, expanding my financial therapy group offerings, supporting clients through their own vulnerable transitions, while raising a family — it was a lot. But every time I connected with my Amy, I was reminded that I wasn’t alone. That I could be both driven and tired, both ambitious and human. When 56Strong was in the planning and matching portion of the process, I told them that the one thing that I wanted in a mentor was a regulated nervous system.

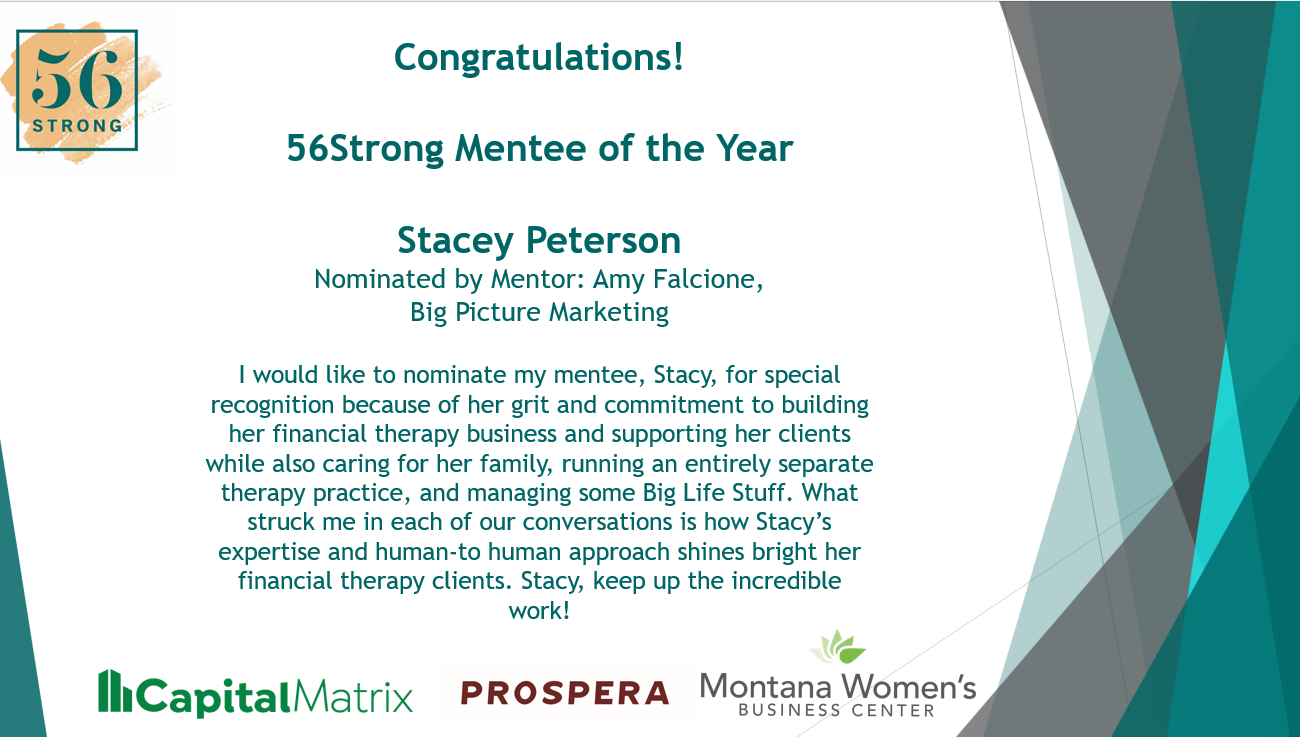

So when I learned that I had been selected as the 2025 56Strong Mentee of the Year, I was deeply honored — and more than a little surprised. To be recognized among so many passionate, resilient, brilliant women across the state is humbling beyond words.

What made it even more meaningful was the nomination my mentor, Amy, submitted. She wrote:

“I would like to nominate my mentee Stacy for special recognition because of her grit and commitment to building her financial therapy business and supporting her clients while also caring for her family, running an entirely separate therapy practice, and managing some Big Life Stuff. What struck me in each of our conversations is how Stacy's expertise and human-to-human approach shines bright for her financial therapy clients. She really, truly, deeply cares about each person she works with. It's evident in conversations with her, reading through her fantastic website, and in her emails. And the material she shares inside the group? Un.be.lievable! It's thoughtful, logical, comprehensive, and approachable — all things I personally aspire to as a teacher. The testimonials for her group reflect the profound financial confidence Stacy empowers in each person, which is inspiring for anyone trying to do good in the world.”

To read those words — to be seen like that — reminded me why I do this work in the first place. Financial therapy isn’t just about spreadsheets and budgets. It’s about stories, emotions, trust, and healing. It’s about creating spaces where people can talk about money without shame and make decisions from a place of clarity instead of fear. To know that my mentor, someone I respect immensely, saw that in me and believed it deserved recognition — I can’t think of a greater gift.

I want to thank the 56Strong organizers (Woo Lindsey Benov!) for creating a program that’s truly rooted in connection. For making sure that women from every corner of Montana feel included, heard, and supported. I’m walking away from this experience with more clarity, deeper confidence, and a sense of responsibility to keep showing up — not just for my own goals, but for the women coming up alongside and behind me.

To my fellow mentees and mentors: thank you for sharing your stories, cheering each other on, and reminding me that leadership looks like many things. Sometimes, it looks like grit. Sometimes, it looks like grace. Most of the time, it’s both.

This award isn’t just a reflection of my year — it’s a celebration of the kind of community we’re building here in Montana. And I’m so, so grateful to be part of it.