How to Financially Prep for a New Year That Aligns With Your Values

Cheers to 2026 being aligned with our values!

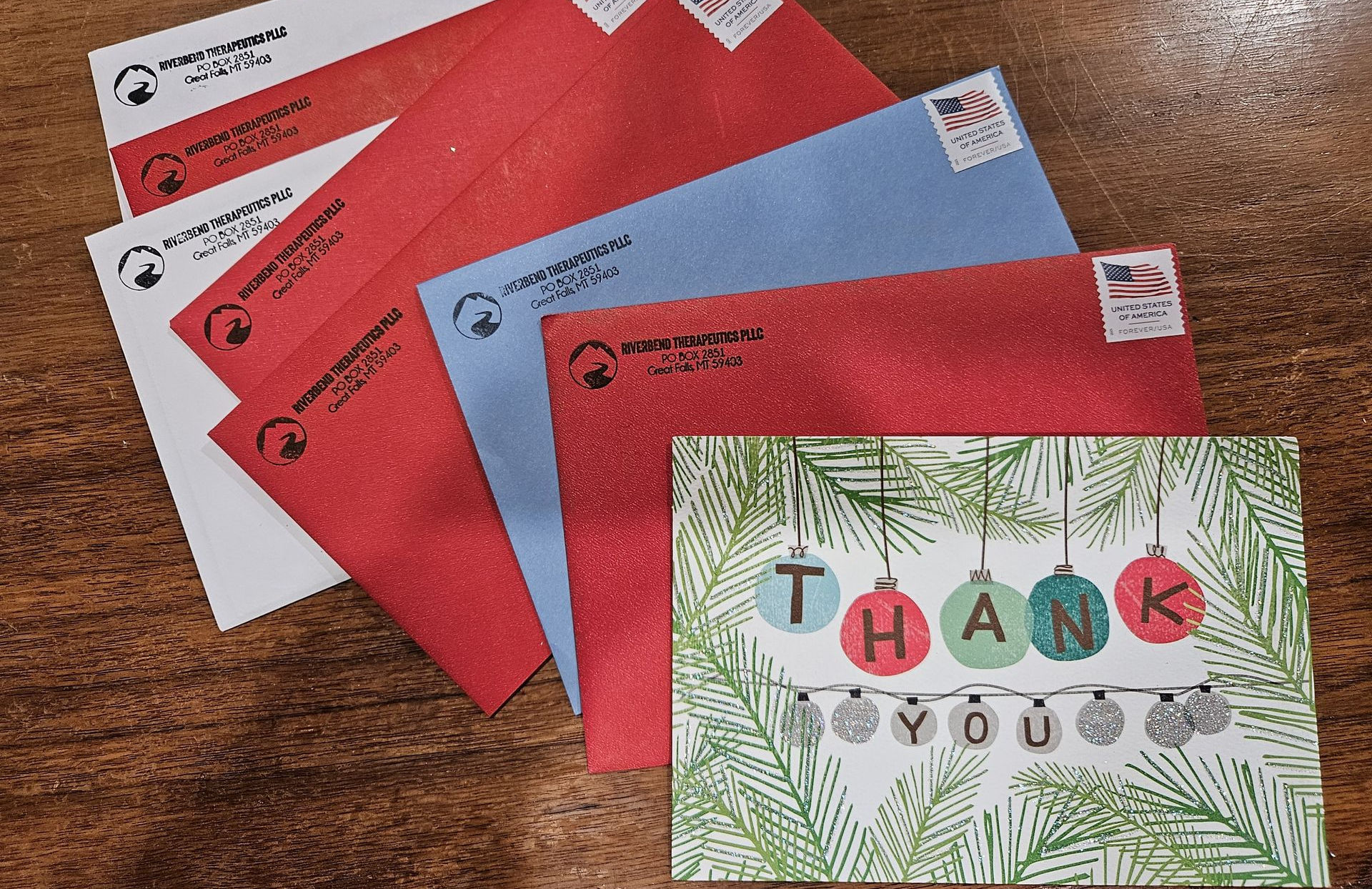

As the year winds down, I have a yearly business ritual I return to every single December.

I sit at my table or my desk with a stack of holiday cards and I slowly, intentionally write notes to the people who helped carry me through the year—the ones who sent referrals, spoke my name in rooms I wasn’t in, offered encouragement when things felt shaky, or simply believed in me when I was building something that mattered deeply to my heart (even if I didn’t know how much it mattered.)

It’s one of my favorite parts of the year. This year it was something that kept getting moved to the bottom of the TO-DO list and when I finally did it after the kids went to bed (a few days after Christmas) I was so sad I waited so long because the words flowed so naturally. Seeing the stack of Christmas cards warmed my heart in the way it does every year.

Not because it’s productive in the traditional sense.

Not because it checks something off a list.

But because it grounds me in why I do what I do.

Reflection Before Resolution

Writing those cards does something powerful. It forces me to pause and look honestly at where I am—and how I got here.

I’m reminded that I am not self-made.

That my work, my practice, my growth didn’t happen in isolation.

That there are

real people

behind every opportunity, every client, every step forward.

This year, I had the pleasure of writing cards to those that helped me grow my financial therapy practice. The enthusiasm that I have for this work was EVIDENT. Reminding me that there have been few times in my life where I truly have felt like I am doing what I was put on this Earth to do.... but being a financial therapist truly feels like that.

So.

I didn’t just write the cards—I sat with each name. I let myself really feel the support that showed up for me in 2025. I reflected on the conversations, the trust, the referrals, the moments where someone saw my passion and said, “Yes, I believe in this.”... "Yes, I believe in her."

And in doing that, something clicked.

This was the year I became the sturdy financial therapist I feel like today.

Not because I worked harder.

Not because I hustled more.

But because I leaned fully into what I value most.

Why This Matters (Financially, Too)

Connection and reciprocity are not just nice ideas to me—they are core values.

And when I honor them, everything shifts.

When I lead with gratitude, my nervous system settles.

When I acknowledge support, I feel resourced instead of alone.

When I practice reciprocity, abundance stops feeling theoretical and starts feeling lived.

What I received this year—professionally, financially, emotionally—came ten-fold when I stayed rooted in those values.

And this is where money comes in.

Values Are the Foundation of Financial Alignment

We often talk about preparing financially for a new year in terms of numbers:

- Budgets

- Goals

- Savings

- Plans

But real financial alignment doesn’t start with spreadsheets.

It starts with values.

When your financial decisions reflect what you deeply care about, money becomes less about restriction and more about expression.

For me, honoring connection looks like:

- Investing time in relationships

- Expressing gratitude openly

- Building a practice rooted in trust and care

Financially, that means I’m willing to allocate money and energy toward things that strengthen those values—because they are the very things that sustain my work and my life.

The same is true for you.

Preparing for a Values-Aligned New Year

As you look ahead to the new year, I invite you to pause before you plan.

Ask yourself:

- Who helped me become who I am this year?

- What values showed up again and again in my life?

- Where did I feel most grounded, most fulfilled, most like myself?

- How did money support—or disconnect me from—those moments?

When you answer those questions honestly, your financial priorities often become much clearer.

Maybe it’s investing more in community.

Maybe it’s creating more margin in your life.

Maybe it’s setting boundaries around spending that no longer aligns.

There’s no one right answer—only your answer.

Money as a Relationship

Money, like relationships, responds to intention.

When we lead with fear or disconnection, it often mirrors that back to us.

When we lead with clarity, gratitude, and values, it tends to soften.

This year taught me that when I honor connection and reciprocity—when I truly live those values—money flows in ways that feel supportive instead of stressful.

That’s the kind of financial preparation I’m carrying into the new year.

Not perfection.

Not control.

But alignment.

And if you’re willing to start there too, you may be surprised by what unfolds.

Money, like relationships, responds to intention.

Intentionality in Financial Therapy

If you would like to begin the new year off with intention and emotional clarity when it comes to your finances, I would love to have a conversation about how I can help guide that intentionality.

- Individual Financial Therapy offers a private space to be able to talk about your specific money story and begin to rewrite that story to be one that aligns with the 2026 version of you!

- Group Financial Therapy offers immediate de-shaming of the where you have gotten to where you are at with your relationship with money. Every group ends up with a very unique blend of personalities, but each group is a safe, kind, supportive place to talk about what is happening with your relationship with money. If you are interested you can fill out the Group Interest Form and let me know when would work for you best!

Happy New Year!